Navigating the end of a company’s journey in the UK involves intricate processes like liquidation and strike-off. Novo Solution is here to streamline this transition, offering comprehensive support for businesses looking to cease operations in the UK.

In-Depth Expertise

Our team at Novo Solution is well-versed in the nuances of UK company law. With extensive experience in various closure processes, including liquidation and company dissolution, we ensure your closure aligns with legal standards and is handled professionally.

We understand that each business has unique needs. Our dedicated specialists provide personalized guidance and advice, ensuring your specific requirements, whether solvent or insolvent liquidation, are met precisely.

Cost-effectiveness is critical in business closure. Novo Solution offers competitive, transparent pricing without hidden fees, catering to your financial concerns during the winding-up process.

We handle all legalities, from deregistration to managing accounts and tax obligations, ensuring a smooth process whether you’re undergoing liquidation or strike-off.

Compliance with UK legal standards is our priority. We navigate the complexities of business dissolution, guaranteeing a compliant and hassle-free process.

Local Features

| Feature | Details |

| Types of Liquidation Available | Members' Voluntary Liquidation, Creditors' Voluntary Liquidation, Compulsory Liquidation |

| Eligibility Criteria for Liquidation | Insolvency for CVL and Compulsory, Solvency for MVL |

| Process and Duration of Liquidation | Involves appointing a liquidator, asset liquidation, creditor payment; duration varies based on complexity |

| Costs and Fees Associated with Liquidation | Includes liquidator fees, court fees, and administration costs; varies depending on the liquidation type |

| Role of Liquidator | Manages the liquidation process, asset sales, creditor payments, and final accounts |

| Creditors’ Rights and Claims Process | Creditors can claim outstanding debts, attend creditors' meetings, and receive reports from the liquidator |

| Tax Clearance Requirements | Clearance required from HMRC for outstanding taxes and final tax returns |

| Reporting and Notification Requirements | Notification to Companies House, creditors, and publication in the Gazette |

| Strike-off Procedures | Voluntary strike-off for dormant/solvent companies; submission of DS01 form, creditor notification |

| Asset Distribution Rules | Prioritize creditors; any surplus is distributed among shareholders |

| Legal Implications and Liabilities | Directors liable for wrongful trading if insolvent; compliance with the Insolvency Act 1986 |

| Documentation and Record-Keeping Requirements | Maintenance of financial records, meeting minutes, liquidation resolution, final accounts |

| Reinstatement Possibilities | Possible under court order within 6 years of dissolution |

| Regulatory Body Overseeing Liquidations | The Insolvency Service and Companies House |

Liquidation involves methodically concluding your UK company’s operations, suitable for those facing financial challenges. It includes various types like Members’ and Creditors’ Voluntary Liquidation, each tailored to the company’s financial state.

Strike-off is an efficient way to dissolve a company with minimal liabilities or dormant status. Essential requirements include ceasing trading activities and no recent company name changes.

Expert Comparison

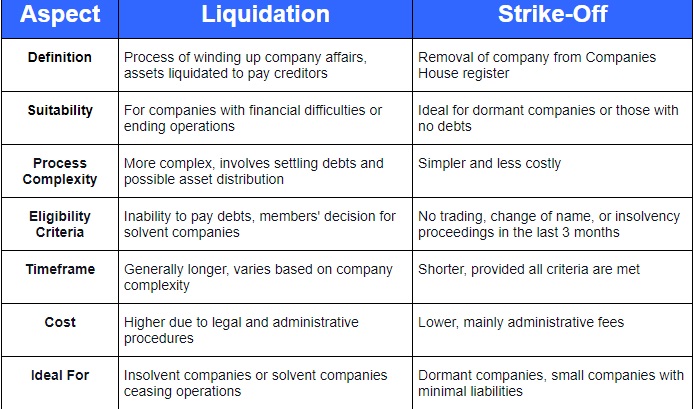

Understanding the difference between liquidation and strike-off is crucial. While liquidation caters to financially strained companies, strike-off is a straightforward option for inactive or debt-free entities.

Navigating Company Closure with Novo Solution

At Novo Solution, we understand the challenges of closing a UK company. Our approach streamlines and simplifies the entire process, making it less daunting for business owners. We handle every step, from the initial assessment to the final dissolution, ensuring a comprehensive service tailored to your needs.

Personalized Initial Consultation

We start with a no-cost initial consultation to assess your company’s requirements and explore the most suitable closure options, liquidation or strike-off. This crucial step helps us understand your business’s unique context and guide you toward the most fitting solution.

Expert Guidance and Compliance

Our team, proficient in UK company law, provides detailed advice on the optimal path for your company’s closure, prioritizing compliance with UK regulations. We navigate the complexities on your behalf, offering expert guidance every step of the way.

Efficient Document Management

We manage all documentation, ensuring that every form and filing is accurately prepared and promptly submitted to Companies House. Our attention to detail guarantees precision in every legal document involved.

Effective Communication

Our role extends to clear and effective communication with all stakeholders, including creditors and authorities. We ensure that all parties are informed throughout the process, maintaining transparency and clarity.

Finalizing the Closure

The culmination of our service is your company’s formal and complete dissolution, including its removal from the Companies House register. This marks the official conclusion of your company’s legal existence, handled professionally and efficiently by Novo Solution.

Novo Solution is dedicated to delivering an efficient and thorough service for the liquidation and strike-off of UK companies. With our focus on detail, compliance, and client support, you can trust us to manage your business’s closure effectively, guiding you smoothly through this critical phase.

Liquidation vs. Strike-Off: Understanding the Distinction

Liquidation suits insolvent companies needing to settle debts through asset distribution. In contrast, strike-off is streamlined and ideal for debt-free companies ceasing operations.

Timeframe for Liquidation in the UK

Liquidation duration is variable, generally spanning several months, influenced by the company’s size and complexity.

Eligibility for Opting for Strike-Off

Strike-off is geared towards companies with no active trading, significant debts, or ongoing disputes, making it unsuitable for all business types.

The liquidator’s key responsibilities include debt settlement, asset liquidation, and distribution of remaining funds to creditors and shareholders.

Transparency in Costs

Novo Solution is committed to transparent cost structures, ensuring clarity about all expenses without hidden charges.

Asset Management during Liquidation

Liquidation typically involves selling assets to clear debts, with any surplus distributed to shareholders.

The Need for Professional Assistance in Dissolution

While not obligatory, expert advice can streamline the dissolution process, guaranteeing legal compliance and ease.

Novo Solution is dedicated to making the closure of your UK business a hassle-free process. Our experienced team ensures that your liquidation or strike-off journey is handled professionally and efficiently, providing a smooth transition.

Recognizing that each business has unique closure costs, we offer bespoke quotes reflecting your requirements. Our competitive pricing is tailored to ensure affordability for your business’s circumstances.

Maximizing Value

At Novo Solution, we prioritize efficient closure strategies that reduce risks and costs, enhancing the value you receive. Our commitment to cost-effectiveness ensures that your business’s liquidation or strike-off is managed economically without compromising quality or compliance.

Begin Your Closure Journey

Contact Novo Solution for a complimentary consultation. We’re here to guide you through every step, ensuring your company’s closure is managed effectively and affordably.

Latest Insights

The Binary By Omniyat, office 112

32 Marasi Drive Street, Business Bay